Op-Ed

Op-Ed section will have latest editorial and analysis...

Enigma of electricity bills

The official machinery in Pakistan has been outrageously proving for years that it is incapable of handling any situation from...

Corruption as faux pas

LAHORE: There is much hype in the electronic and print media about corruption in Pakistan, but this menace persisted even...

Pakistan improves world ranking, but …

The World Economic Forum's (WEF) has issued a Global Competitiveness Report for 2014 – 2015, indicating that there is improvement...

Political crisis amid inflation

The warning bells are ringing from all sides amid political crisis in Islamabad. The whole world is watching developments in...

In the hope of future

The foreign missions situated in the Red Zone have been closed down for five days owing to volatile situation in...

Economy in the dock

Through their contradictory statements, the government ministers have been repeatedly warning the nation about billions of rupees losses to the...

SBP financing for small exporters

The State Bank of Pakistan (SBP) has spelled out various incentives for small exporters, providing refinancing facility to Small and...

Visit of FBR tax delegation to Switzerland: The hype vs reality

The visit of the FBR delegation to Switzerland to discuss the double taxation agreement and convince Swiss authorities to make...

Protecting small financial consumers

When you enter a bank branch, the spick and span staff will welcome you with a broad smile provided that...

Youths: From assets to liability

Pakistan is blessed with intelligent brains and myriad of hardworking workforce, but how much is its utility in this land...

Arresting rupee value

According to the director of the monetary policy of the State Bank of Pakistan, the recent political confrontation is responsible...

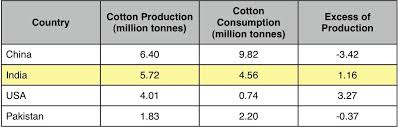

Cotton year in India and Pakistan

India has declared 2014 as the cotton year and has set an ambitious target of producing nearly 40 million bales...

Need to work out win-win solution

The political chaos created by the sit-ins by Pakistan Tehreek-e-Insaf chief Imran Khan and Pakistan Awami Tehreek leader Dr Tahirul...

Effects of protest rallies on business

LAHORE (AFTAB AFZAL RANJHA): Pakistan Tehreek-e-Insaf (PTI) chief Imran Khan and Pakistan Awami Tehreek (PAT) chief Dr Tahirul Qadri are...

Implications of political chaos

LAHORE (AFTAB AFZAL RANJHA): If a strong industrial-base ensures welfare of the people, a strong political system guarantees a conducive...

Bringing retailers into tax net

Federal Board of Revenue has devised rules for implementing the taxation steps taken by the government through Finance Bill 2014-15....

Well done FBR

The FBR has collected Rs 324 billion more in fiscal year 2013-14 by collecting Rs 2270 billion against a collection...

Privatization and Transparency

ISLAMABAD: After pause of seven years, Pakistan has entered into domestic as well as international capital market to offload its...

FBR’s Taxation Measures

Federal Board of Revenue is making efforts to broaden its tax base and in the outgoing financial year ending on...

Budget 2014-15: highly ambitious tax target

The government has fixed highly ambitious tax collection target of Rs 2,810 billion for FBR in the budget 2014-15 against...