Islamabad

Pakistan’s first in-depth newspaper that presents balanced news reports, analysis and reviews regarding Customs, Federal Board of Revenue (FBR) and Sales/Income Tax Departments beside covering import and export sectors comprehensively. Up-to-the-minute news bulletins regarding Customs and FBR departments are also displayed regularly on both website and face book for the interest of common people

Currency declaration is not a new development, FBR negates misleading information

ISLAMABAD: The Federal Board of Revenue (FBR) has negated the misleading information that the requirement of submitting currency declarations from...

Pakistan may not be able to achieve Rs.7.47 trillion tax target amid floods

ISLAMABAD: Pakistan may not be able to achieve tax collection target of Rs7,470 billion as the country faces worst devastation...

FBR appoints Muhammad Nadeem Arif as DG Anti Benami Initiatives

ISLAMABAD: Federal Board of Revenue (FBR) has appointed Muhammad Nadeem Arif, a BS-21 officer of Inland Revenue Services (IRS), as...

AIIB appreciates govt’s economic policies

ISLAMABAD: The Asia Infrastructure and Investment Bank (AIIB) Friday appreciated the economic policies and reforms of the present government for...

ZTBL contributes 10pc of its net income to flood victims

ISLAMABAD: The Zarai Taraqiati Bank Limited (ZTBL) contributed 10 percent of its net profit for the rehabilitation of flood victims...

Committee constituted to address Chinese IPPs’ concerns

ISLAMABAD: Federal Minister for Finance and Revenue, Miftah Ismail here on Friday formed a committee to hold meetings with Chinese...

FBR makes arrangements for speedy clearance of relief consignments

ISLAMABAD: The Federal board of Revenue (FBR) has instructed all Chief Collectors of Customs to ensure effective coordination with the...

Country economy going through hard times due to floods: Miftah

ISLAMABAD: Minister for Finance and Revenue Miftah Ismail said that due to devastating floods in the country, the economy is...

ECC approves flood-relief funds, gives go ahead for fertilizer import

ISLAMABAD: The Economic Coordination Committee (ECC) of the Cabinet approved funds for relief and rescue of flood-affected people and also...

Govt okays names for MDs of OGDCL, PPL

ISLAMABAD: The federal government has finalized names for appointment of managing directors in Oil and Gas Development Company (OGDCL) and...

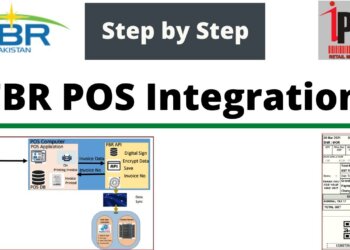

FBR directs 81 retailers to integrate with POS system by Sep 10

ISLAMABAD: The Federal Board of Revenue (FBR) directed 81 retailers to integrate with the online system by September 10, 2022...

Sep 30 last date for income tax returns: FBR

ISLAMABAD: The Federal Board of Revenue (FBR) has started collecting income tax returns from salaried business individuals and associations of...

Qatar Investment Authority keen to invest in Pakistan’s multiple sectors

ISLAMABAD: Chief Executive Officer (CEO), Qatar Investment Authority, Sheikh Faisal bin Thani al-Thani has shown keen interest to invest in...

CCoP takes steps to further privatisation of NPPMCL

ISLAMABAD: The Cabinet Committee on Privatisation (CCOP) has allowed the re-engagement of a financial advisor to further the process of...

Senate panel directs to strengthen foreign currency disclosure process at airports

ISLAMABAD: The Senate Standing Committee on Finance has directed the Ministry of Finance (MoF) to streamline the process of disclosure...

Maritime Affairs Ministry donates Rs70m in PM Relief Fund

ISLAMABAD: Ministry of Maritime Affairs on Tuesday made a donation of worth Rs70 million to Prime Minister’s Relief Fund. Minister...

Supply of verified flood-related goods exempted from whole of sales tax, clarifies FBR

ISLAMABAD: The Federal Board of Revenue (FBR) on Tuesday clarified that the supply of local and international flood-related goods are...

MoF, FBR agree to clear Rs36b deferred GST refunds

ISLAMABAD: The Ministry of Finance and the Federal Board of Revenue (FBR) have agreed to clear Rs36 billion deferred sales...

Pakistan needs enhanced financing for natural disasters: ADB

ISLAMABAD: Pakistan urgently needs to enhance the current disaster risk finance approach as risk retention mechanisms are insufficient to cover...

ATIR summons FBR’s Member Operations IR on Sept 7

ISLAMABAD: The Appellate Tribunal Inland Revenue, Islamabad (ATIR) has found some serious violations of law in the recovery of tax...