Islamabad

Pakistan’s first in-depth newspaper that presents balanced news reports, analysis and reviews regarding Customs, Federal Board of Revenue (FBR) and Sales/Income Tax Departments beside covering import and export sectors comprehensively. Up-to-the-minute news bulletins regarding Customs and FBR departments are also displayed regularly on both website and face book for the interest of common people

FBR needs to address structural problems in taxation system: SBP

KARACHI: The Federal Board of Revenue (FBR) has failed to address structural problems in the taxation system and tax-to-GDP ratio...

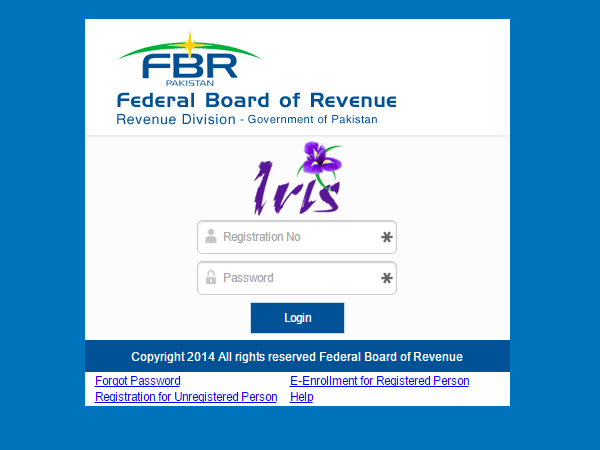

FBR decides to de-centralize computer system to address IRIS complaints

ISLAMABAD: Federal Board of Revenue Chairman Nisar Mohammad Khan has directed officials concerned to de-centralize the computer system. More powers...

Dar to lay Income Tax (Second Amendment) Ordinance, 2015 before NA today

ISLAMABAD:Federal Finance Minister Ishaq Dar, will lay the Income Tax (Second Amendment) Ordinance, 2015 before the National Assembly today (Friday)....

FBR seeks Mansha family’s investment details from UK Customs

ISLAMABAD: The Federal Board of Revenue (FBR) has asked Her Majesty Revenue and Customs, United Kingdom to provide details of...

Customs Tribunal orders release of 6300kg Indian Black Pepper

ISLAMABAD: Customs Appellate Tribunal Bench-II has released 6300 kilograms of Indian Black Pepper which was termed as confiscated by customs...

IHC dismisses reference filed by RTO due to non-prosecution

ISLAMABAD: The Islamabad High Court (IHC) dismissed an income tax reference filed by Regional Tax Officer (RTO) due to non-prosecution....

USAID seeks tax exemptions to run development project

ISLAMABAD: The United States Agency for International Development, which is working in Pakistan on various development projects, has demanded duty/taxes...

Rate of direct taxes more as compared to previous fiscal year

ISLAMABAD: The rate of direct taxes is more than other taxes during the financial year 2014-15 as compared to previous year...

Economic division seeks excemption of duty on USAID equipments

ISLAMABAD: The United States has asked the Customs Department to give duty exemption on import and buying equipment under the USAID health...

Performance allowance of 493 Customs officers of BS-16 restored

ISLAMABAD: Federal Board of Revenue has restored the performance allowance of 493 Pakistan Customs Service officers of BS-16 after three...

FBR receives 36,000 complaints about IRIS software

ISLAMABAD: The Federal Board of Revenue has received 36,000 objections from taxpayers about IRIS system, it is learnt here. According...

IHC disposes of five petitions filed against RTO authorities

ISLAMABAD: Justice Aamer Farooq of Islamabad High Court (IHC) on Wednesday disposed of five writ petitions filed against Regional Tax...

ANF recovers 306 Kgs drugs, arrests six accused

ISLAMABAD: Anti-Narcotics Force (ANF) has recovered 306 kilograms of Drugs and arrested six accused including two ladies in five different...

FIA arrests two human traffickers from Rawalpindi

ISLAMABAD: The Federal Investigation Agency (FIA) has arrested two human traffickers from Rawalpindi and recovered three passports and three visas...

Customs Tribunal Bench-II postpones hearing of 2 cases till Dec 23

ISLAMABAD: Customs Appellate Tribunal Bench-II on Wednesday adjourned hearing of couple of cases till December 23 after brief hearings. Single...

FBR files plea in Supreme Court over release of seized goods

ISLAMABAD: Federal Board of Revenue submitted an application in Supreme Court about release of seized goods. According to details advocate...

FBR Chairman Nisar Khan assures IMF officials of achieving revenue targets

ISLAMABAD: Federal Board of Revenue (FBR) Chairman Nisar Mohammad Khan will reach Islamabad after taking part in negotiations with IMF...

DG Customs Intelligence Imtiaz Ahmed directs staff to remian on high alert

ISLAMABAD: Director General Customs Intelligence and Investigation Imtiaz Ahmed Khan has directed the Customs Intelligence staff to remain on high alert. Sources...

MoC takes numerous measures to promote exports

Ministry currently reviewing the impact of Preferential Trade Agreement for a possible FTA with Indonesia ISLAMABAD: The Ministry...

Customs Appellate Tribunal reserves verdict of two cases filed by Atlas Honda

ISLAMABAD: Customs Appellate Tribunal on Tuesday reserved judgment in two cases filed by Atlas Honda Limited. Customs Appellate Tribunal’s Special Division...