Islamabad

Pakistan’s first in-depth newspaper that presents balanced news reports, analysis and reviews regarding Customs, Federal Board of Revenue (FBR) and Sales/Income Tax Departments beside covering import and export sectors comprehensively. Up-to-the-minute news bulletins regarding Customs and FBR departments are also displayed regularly on both website and face book for the interest of common people

FTO declares DC Customs Adjudication action lawful

ISLAMABAD: The Federal Tax Ombudsman (FTO) has dismissed a complaint filed against Deputy Collector Customs (Adjudication) alleging him for being...

Customs Intelligence recovers smuggled goods worth Rs 260m in December

ISLAMABAD: The Directorate General Customs Intelligence and Investigation Islamabad seized Rs 260 million smuggled goods, registered 90 cases against the...

Rawalpindi Customs Intelligence impounds 7 vehicles worth Rs 95 million

ISLAMABAD: The Directorate of Customs intelligence and Investigation Rawalpindi impounded seven non-customs paid vehicles during December 2015. Following the special...

SC specials benches to hear pending revenue cases after Jan 19

ISLAMABAD: The Supreme Court will start hearing of the pending revenue cases by forming special tax benches at both SC...

FBR to approach International Court of Justice against Kuwait-based company

ISLAMABAD: The Federal Board of Revenue (FBR) has decided to approach the International Court of Justice for recovery of $ 11...

Three member panel to conduct proceedings of Islamabad High Court

ISLAMABAD: Proceedings of the Islamabad High Court will be maintained by the three member panel of the court, including the...

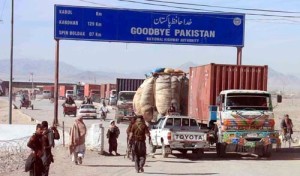

Govt to establish Land Port Authority at Pak-Afghan border

ISLAMABAD: The federal government has decided to establish a Land Port Authority to curb smuggling and document the transit trade...

PM likely to announce ‘Voluntary Tax Compliance Scheme’ on January 1

ISLAMABAD: Prime Minister Nawaz Sharif is likely to announce “Voluntary Tax Compliance Scheme” on January 1, 2015 for registration of...

Imtiaz Ahmad assumes look-after charge as DG IPR (Enforcement)

ISLAMABAD: Imtiaz Ahmad Khan, a Pakistan Customs Service officer of BS-21, has assumed the look-after charge of the post of...

Member Dr Irshad visits Gujranwala RTO to motivate employees

ISLAMABAD: Dr Muhammad Irshad, Member (IR-Operations), has Regional Tax Office, Gujranwala, to motivate the employees and assured them his full...

FBR Chairman Nisar Mohammad to address Pakistan Governance Forum today

ISLAMABAD: Federal Board of Revenue (FBR) Chairman Nisar Mohammad Khan will address the Pakistan Governance Forum on Thursday (today). Federal...

Need to take steps to curb misuse of tax laws: Ahmad Dildar

ISLAMABAD: The government is asked to make tax laws tougher, besides rectifying the system by eliminating flaws and loopholes, which...

Zero tolerance for corruption in Customs Adjudication, says Deputy Collector Ubaid Ullah

ISLAMABAD: Deputy Collector Adjudication Headquarters Ubaid Ullah has said that during the first month of the new year all systems...

Traders appreciate concessional package by govt

ISLAMABAD: The All Small Trader Itehad has appreciated the concessional package for the traders offered by the federal government. According...

FBR seeks budget proposals for FY2016-17

ISLAMABAD: The Federal Board of Revenue (FBR) has sent letters to chambers of commerce seeking their budget proposals for next...

SC rejects drug peddler’s petition against conviction

ISLAMABAD: Supreme Court of Pakistan dismissed the petition of accused Khan Haider who was awarded life imprisonment along with fine...

FIA arrests three human smugglers, recovers 31 passports

ISLAMABAD: FIA has arrested three human traffickers including a lady from Islamabad and recovered 31 passports from their possesion. Sources...

IHC postpones hearing of case filed against RTO official

ISLAMABAD: The Islamabad High Court (IHC) on Tuesday adjourned the hearing of a case filed against officer of Regional Tax...

FBR Chairman Nisar Mohammad presides over Board-in-Council meeting

ISLAMABAD: Federal Board of Revenue (FBR) Chairman Nisar Mohammad Khan has presided Board-in-Council meeting. The participants of the meeting hail...

FBR, China Customs for completing ‘customs online project’ by June 2016

ISLAMABAD: The Federal Board of Revenue (FBR) and General Administration of Customs People’s Republic of China agreed to complete the...