Islamabad

Pakistan’s first in-depth newspaper that presents balanced news reports, analysis and reviews regarding Customs, Federal Board of Revenue (FBR) and Sales/Income Tax Departments beside covering import and export sectors comprehensively. Up-to-the-minute news bulletins regarding Customs and FBR departments are also displayed regularly on both website and face book for the interest of common people

Collector North Sarwat Tahira allows inspection of containers at Sost Dry Port

ISLAMABAD: Chief Collector North, Sarwat Tahira Habib has allowed Directorate Customs Intelligence and Investigation Rawalpindi for combine inspection of bolted...

Commerce Ministry seeks Free Trade Agreement with EEU

ISLAMABAD: The Ministry of Commerce is trying to initiate talks to sign Free Trade Agreement (FTA) with Eurasian Economic Union (EEU)....

Finance Ministry submits SBP’s 1Q report on state of economy in Senate

ISLAMABAD: The Finance Ministry has presented the first quarterly report of the State Bank of Pakistan for the fiscal year...

Pakistan shares draft of 5 year strategic plan with Iran to enhance bilateral trade

ISLAMABAD: Pakistan has shared the draft of proposals and recommendations of the five year strategic plan with Iran to enhance...

Customs Islamabad to celebrate Int’l Customs Day at Dry Port Margalla

ISLAMABAD: Customs Collectorate Islamabad will celebrate International Customs Day at Dry Port of Margalla Railway Station. Sources told Customs...

Developing nations taking advantages of Information Technology: Member Customs FBR Nasir Masroor

ISLAMABAD: Federal Board of Revenue Member Customs Nasir Masroor in his message on World Customs Day said that “Information and...

IHC issues notice to Customs Appellate Tribunal in references filed by two firms

ISLAMABAD: The Islamabad High Court (IHC) on Friday issued notices to Customs Appellate Tribunal for appearing before the court as...

IHC dismiss income tax reference on interest payment to Ghazi Barotha project’s contractors

ISLAMABAD: Islamabad High Court has dismissed an income tax reference seeking charging of tax on an amount of interest paid...

ADB supports Pakistan to enhance trade with Central Asia: Dr Werner Liepach

ISLAMABAD: Security and energy shortages are the main challenges of Pakistan. GDP growth is still below the rate required to...

Customs Court to hear Ayyan Ali case on Jan 26

ISLAMABAD: The Special Court of Customs will hear money laundering case against super model Ayyan Ali on January 26, 2016....

PM Nawaz hails Customs Dept for enforcing national, int’l laws on cross-border trade

ISLAMABAD: Prime Minister Nawaz Sharif has congratulated the Customs Department and the Federal Board of Revenue (FBR) on the progress...

Pakistan Customs to continue treading on the path of modernisation: Dar

Finance Minister Ishaq Dar says Pakistan Customs made significant growth in digital innovation ISLAMABAD: Federal Finance Minister Ishaq Dar has...

FBR lauded for services to national economy

ISLAMABAD: The Finance Ministry, while defending position on promulgation of the Income Tax (Amendment) Bill 2016, highly appreciated the services...

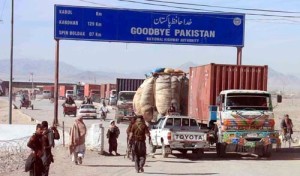

FBR receives 8 complaints out of 60,000 GDs under Pak-Afghan Transit Trade

ISLAMABAD: Due to good performance of the Pakistan Customs, the Federal Board of Revenue (FBR) received only eight complaints out of...

GPA spends Rs 1m on social sector programs, development of underprivileged areas in Gwadar

ISLAMABAD: Gwadar Port Authority (GPA) has spent Rs 1 million on the social sector programs and the development of underprivileged areas...

ANF seizes 154kgs drugs worth Rs 514m in different operations

ISLAMABAD: The Anti-Narcotics Force (ANF), in its drive against drug trafficking, launched operations in Attock, Lahore, Sialkot, Peshawar and Karachi, which...

IHC postpones hearing reference filed by M/s Pak Telecom Mobile Limited

ISLAMABAD: The Islamabad High Court (IHC) on Thursday adjourned the hearing of an Income Tax Reference (ITR) involving chargeable Federal...

Customs Appellate Tribunal adjourns hearing of three cases until Feb 11

ISLAMABAD: The Customs Appellate Tribunal Bench-II on Thursday adjourned the hearing of three customs cases until February 11. A singe bench...

National Assembly adopts tax amnesty bill despite protest by Opp

ISLAMABAD: Despite severe protest by the Opposition parties, the National Assembly has adopted the tax amnesty bill, which aims to...

FBR collects Rs 125b in first 18 days of new year

ISLAMABAD: Federal Board of Revenue (FBR) has collected Rs125 billion during first 18 days of January 2016, showing 30 per...