Islamabad

Pakistan’s first in-depth newspaper that presents balanced news reports, analysis and reviews regarding Customs, Federal Board of Revenue (FBR) and Sales/Income Tax Departments beside covering import and export sectors comprehensively. Up-to-the-minute news bulletins regarding Customs and FBR departments are also displayed regularly on both website and face book for the interest of common people

Ayyan Ali to appear before LHC’s Rawalpindi bench today

ISLAMABAD: Model Ayyan Ali will appear before a Rawalpindi bench of the Lahore High Court (LHC) on Tuesday (today). She has...

IHC division benches will hear nine tax references today

ISLAMABAD: The Islamabad High Court (IHC) will hear nine tax references on Tuesday involving Appellate Tribunal Inland Revenue (ATIR) and...

IHC adjourns hearing of cases filed against Customs Appellate Tribunal, ATIR

ISLAMABAD: The Islamabad High Court (IHC) on Monday adjourned the hearing of cases after connecting them with main cases involving...

Health ministry seeks concession on ST, duty on import of salter scales

ISLAMABAD: Federal health ministry sought concessions on customs duty, sales tax on import of salter scales being used in lady...

FST three benches adjourn hearing of cases filed by FBR employees

ISLAMABAD: Three division benches of the Federal Service Tribunal (FST) adjourned the hearing of cases filed by employees of the...

Apex court dismisses Ayyan’s petition for action against interior ministry

ISLAMABAD: The Supreme Court has dismissed supermodel Ayyan Ali’s petition for initiating contempt proceedings against the Ministry of Interior officials...

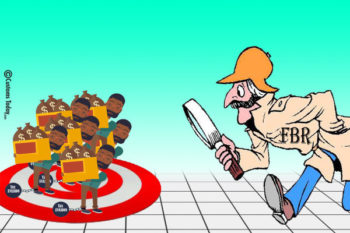

FBR conducting survey to ascertain quantum of smuggling

ISLAMABAD: Federal Bureau of Revenue (FBR) is conducting a robust survey to ascertain quantum of smuggling and to analyse its...

350 non-filers get over Rs 2.09b documented under VTCS in 24 days

ISLAMABAD: As many as 350 non-taxpayers have got their untaxed working capital of over Rs 2.09 billion documented till April...

FBR reviews GST regime to send proposals for budget 2016-17

ISLAMABAD: The Federal Board of Revenue (FBR), in a bid to broaden the tax base, is carrying out a comprehensive...

Customs Appellate Tribunal issues notice to tax authorities on Ayyan Ali’s plea

ISLAMABAD: Model Ayyan Ali has challenged the verdict of the customs adjudication, in which a penalty of Rs 50 million...

CDA moves FTO against recovery of Rs 700m by Islamabad RTO

ISLAMABAD: The Capital Development Authority (CDA) has moved the Federal Tax Ombudsman (FTO) against the Islamabad Regional Tax Office’s (RTO)...

IHC summons LTU commissioner in TF Pay Phone case

ISLAMABAD: The Islamabad High Court (IHC) has issued notices to an officer of the Large Taxpayers Unit (LTU) to appear...

DC Obaidullah directs to release consignment of skimmed milk after payment of duty, taxes

ISLAMABAD: Deputy Collector Customs Adjudication Obaidullah Khan has issued Order-in-Original (ONO) in the seizure case of foreign origin skimmed milk...

IR Tribunal directed to settle Mari Petroleum’s appeal within 45 days

ISLAMABAD: A single bench of the Islamabad High Court (IHC) directed the Appellate Tribunal Inland Revenue to decide Mari Petroleum...

Customs North Region duty collection up 8.5pc during 9 months

ISLAMABAD: The Customs North Region has surpassed the revenue target of the first nine months of the current financial year....

FBR to consult provincial stakeholders to resolve issue of double taxation on rental income

ISLAMABAD: The Federal Board of Revenue (FBR) will resolve the issue of double taxation on rental incomes in consultation with...

Customs Intelligence seizes seat covers for vehicles worth Rs 2m

ISLAMABAD: The Directorate of Custom Intelligence and Investigation has confiscated vehicles’ seat covers worth Rs 2 million, besides impounding the...

IHC disposes of two tax referenes against FBR

ISLAMABAD: The Islamabad High Court (IHC) on Friday disposed of two tax references filed against field offices of the Federal...

DG Imtiaz Ahmad in Karachi to review anti-smuggling operations

ISLAMABAD: Director General of the Directorate of Intelligence and Investigation Imtiaz Ahmed Khan is visiting Custom House Karachi to inspect...

Nadeem Dar appointed as Member Accountant ATIR

ISLAMABAD: The Federal Ministry of Law and Parliamentary Affairs has approved the appointment of Nadeem Dar as member accountant in...