Illustrations

Pakistan’s first in-depth newspaper that presents balanced news reports, analysis and reviews regarding Customs, Federal Board of Revenue (FBR) and Sales/Income Tax Departments beside covering import and export sectors comprehensively. Up-to-the-minute news bulletins regarding Customs and FBR departments are also displayed regularly on both website and face book for the interest of common people

NATO containers stealing: M/s Water Link submits interim reply

KARACHI: The M/s Water Link has submitted 18-page interim written reply in the Collectorate of Customs Adjudication on Friday (August...

Karachi bourse bounces back with 793 points gain

KARACHI: The Karachi Stock Exchange 100-index bounced back on Friday with 793.31 points gain to close at 28,567.74, on the...

Customs, Drug Regulatory Authority lock horns over pharmaceutical material

KARACHI: The clearance of pharmaceutical raw material allegedly by the customs officials without getting prior permission from the Federal Drug...

Closing: KSE crashes down, tumbles 1,079 points in 3 days

KARACHI: The Karachi Stock Exchange (KSE) 100-Index continued to fall for the third consecutive day on Wednesday as it tumbled...

Stealing NATO containers: M/s Water Link served final notice

KARACHI: The Collectorate of Customs Adjudication-I has issued final hearing notice to M/s Water Link for presenting its view point...

Customs seizes Q-Mobile handsets for Rs 770m tax evasion

MULTAN: First time in the history of Model Customs Collectorate Multan, Collector Sarfraz Warraich and his team detected the largest...

Customs appraisement-West arranges seating for visitors

KARACHI: The Model Customs Collectorate (MCC) of Appraisement (West) taking the grievances and issues of traders’ community, importers and Customs...

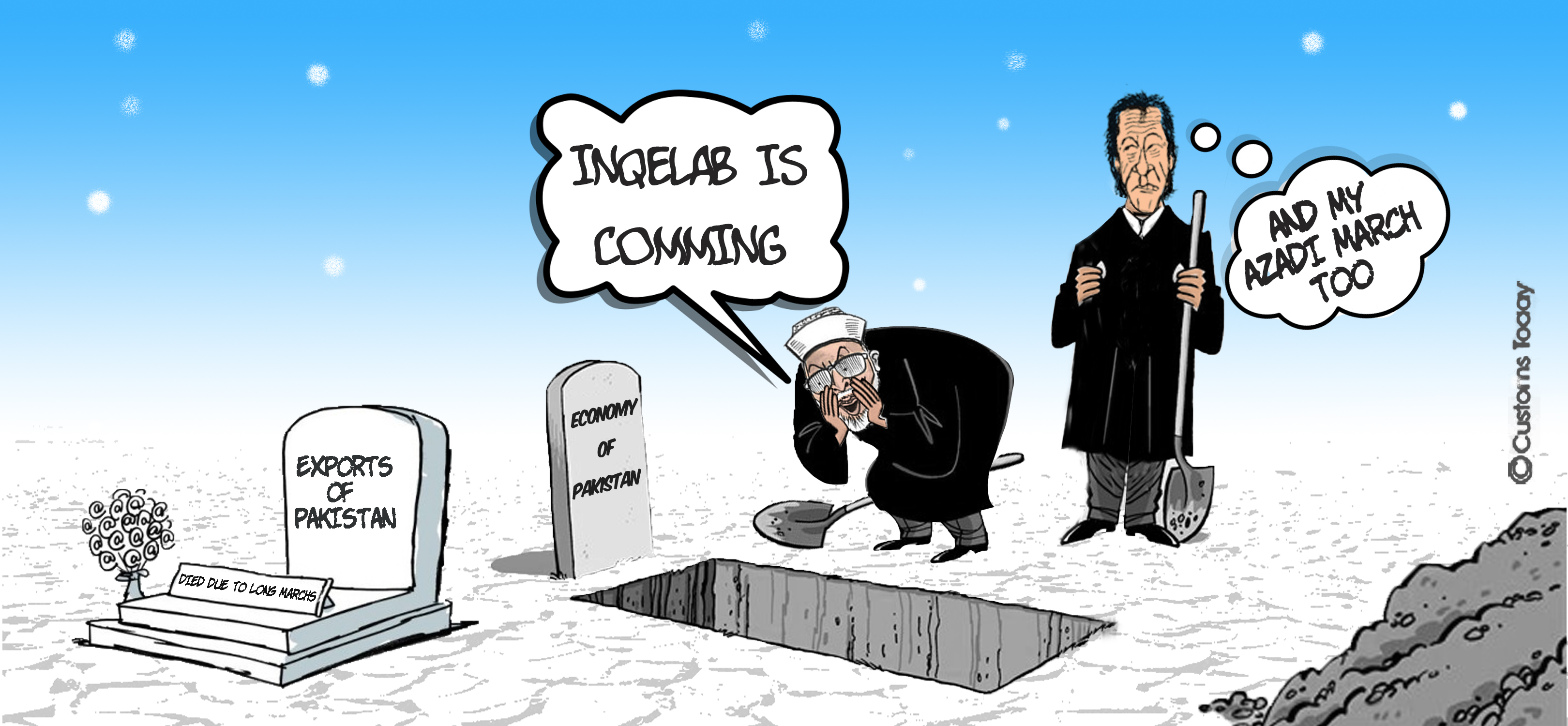

Azadi, Inqilab marches cause colossal loss to economy

ISLAMABAD: The uncertainty and turmoil caused by the Azadi and Inqilab marches of Pakistan Tehreek-e-Insaf (PTI) and Pakistan Awami Tehreek...

Long marches inflict Rs 300b loss on national economy: Dastgir

ISLAMABAD: While terming long march as economical murder of the country, the Commerce Minister has said that ongoing long marches...

Rs4,145m tax evasion: Show-cause issued against Shaheen Air Int’l

KARACHI: A show-cause notice against M/s Shaheen Air International Limited for its involvement in huge tax evasion of Rs4,145 million...

Survey begins in Punjab to collect luxury tax

SIALKOT: The Excise and Taxation Department has started survey to assess the new value of the public properties in Gujranwala...

FBR exceeds revenue target by Rs 1 billion in July

ISLAMABAD: The committed work of field formation officers under new acting Chairman helped the Federal Board of Revenue (FBR) in...

TCS smuggling scandal: Court extends bail of Hamdani, Shakirullah

ISLAMABAD: Customs court has extended anticipatory bail granted to TCS Chief Executive Saqib Hamdani and Smart Zone Company’s owner Shakirullah...

GSP status boosts textile exports to $13.74b

ISLAMABAD - Textile exports surged to $13.74 billion during previous financial year 2013-2014 mainly because of the GSP Plus status...

Tahirul Qadri tax evasion: FBR to unfold investigations soon

ISLAMABAD: Federal Board of Revenue reportedly completed investigations into Pakistan Awami Tehrik (PAT) chairman Dr Tahirul Qadri’s Rs 770 million...

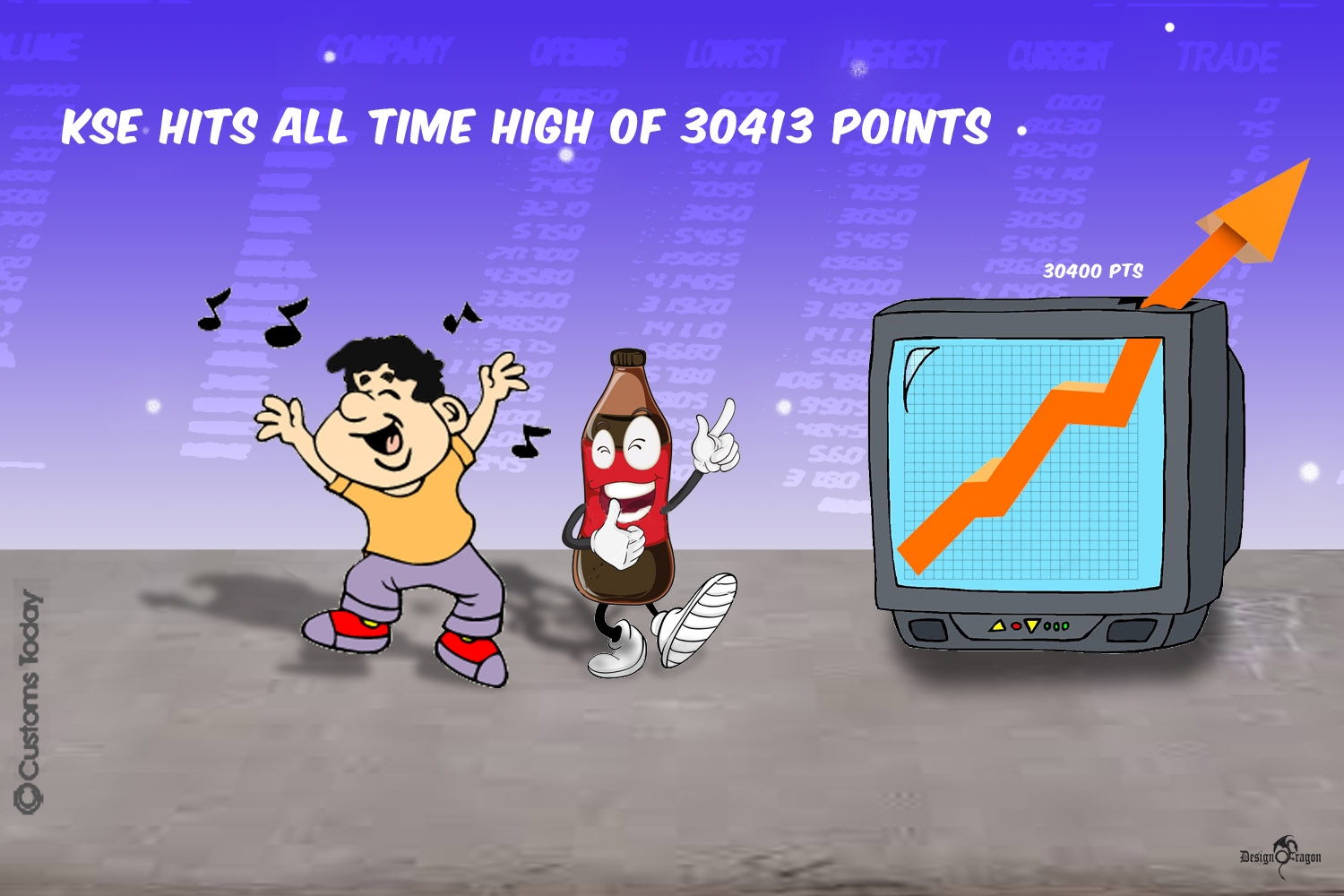

KSE hits all-time high of 30413.23 points

Karachi Stock Exchange (KSE) closed at 30413.23 all time high amid higher trades after SBP mentioned improving economic conditions. KSE...

Govt decides to appoint Tariq Bajwa as Finance Secretary

ISLAMABAD: The government has decided to appoint FBR Chairman Tariq Bajwa as Finance Secretary, sources told Customs Today. Sources said...

TCS finds scapegoat for smuggling scandal

ISLAMABAD: The Courier Service (TCS) administration dismissed its Chief Executive Saqib Hamdani and Islamabad Regional Manager Logistics Ghazanfar Gul amid...

FBR takes back notices issued to Misbah, Hafiz, Akmal, Azhar

LAHORE: FBR has taken back notices issued to national cricket players including Captain Misbah-ul Haq as an outcome of their...

FBR achieves its revenue collection target

ISLAMABAD: After tough struggle throughout the year, Federal Board of Revenue has reportedly achieved its revenue collection target for the...